T-Kash Telkom Mobile Money Transfer Charges, Registration and Agents

What is T-kash?

T-kash is Telkom Kenya’s Mobile money transfer Service that enables you to send money, pay bills and buy goods quickly just like mpesa.

What can you do with Telkom T-kash

With T-kash you can;

- Send and receive money to and from all networks in Kenya anytime.

- Deposit, withdraw and keep track of your money from anywhere.

- Shop at registered Merchant outlets.

- Pay your utility bills.

- Buy airtime for your line and other Telkom customers.

- Buy Telkom data bundles directly without having to buy airtime.

- Directly select Popular and frequently used biller numbers e.g. KPLC, Star Times, NHIF, DSTV etc from your menu, for fast sure payments.

- Save and select your Favourite contacts, billers and bank accounts right from your menu ane never worry about sending money to the wrong recipient.

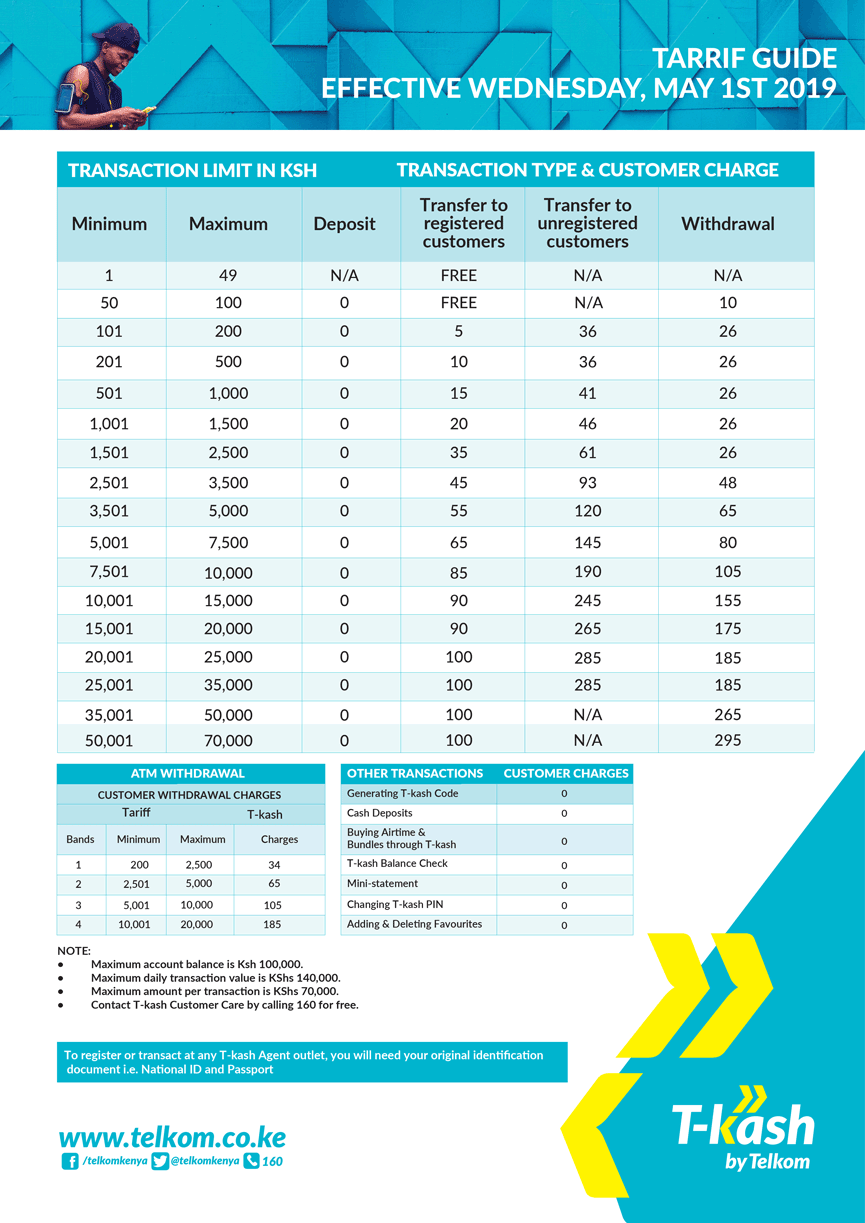

T-kash transactions charges

Find below t-kash by telkom kenya transaction cots;

MORE WAYS TO WITHDRAW YOUR CASH

Enjoy hassle-free ways to withdraw your cash without the need of an Agent number. Simply present your original identification document.

How to Withdraw Cash from an Agent

1. Visit the nearest T-kash Agent.

2. Confirm the T-kash Agent has sufficient funds to process your transaction.

3. Give the Agent your original identification document.

4. Go to your T-kash Menu and select ‘Withdraw Cash’.

5. Select ‘From Agent’enter the amounts.

6. Confirm details, enter your T-kash PIN and press send.

7. You will receive a T-kash SMS with a T-kash Code that is valid for 10 minutes.

8. Give the Agent the T-kash Code to process your withdrawal request.

9. The Agent will process your withdrawal request and you will receive a confirmation SMS from T-kash.

10. The Agent will give you money and request you to sign the transaction logbook.

How to Withdraw Cash from an ATM

You can conveniently withdraw money from all Verve branded ATMs countrywide.

1. Go to your T-kash Menu and select ‘Withdraw Cash’.

2. Select ‘From ATM’.

3. Enter Amount (In multiples of KShs. 200).

4. Create your One Time PIN (Enter a four-digit PIN of your choice).

5. Enter your T-kash PIN and press send.

6. You will receive a T-kash confirmation SMS with a T-kash Code that is valid for 10 minutes.

Phase 2 (At the ATM)

1. At the ATM select ‘Verve’.

2. Enter your ‘T-kash Code’ as the ‘Paycode’.

3. Enter your One Time PIN.

4. Enter amount and confirm by pressing ‘Continue’.

5. The ATM will dispense cash and issue you with a transaction receipt.

6. You will also receive a T-kash confirmation SMS

Open to All

Not registered? Don’t worry. T-kash allows unregistered customers to withdraw money from our Agents. All you have to do is:

1. Confirm the T-kash Agent has sufficient funds to process your transaction.

2. Present your original identification document.

3. Give the Agent your phone number and the T-kash Voucher Code Number from the SMS notification.

4. The Agent will process your withdrawal request and you will receive a T-kash confirmation SMS.

5. Both the Agent and the Customer will receive an SMS confirming the transaction.

7. The Agent will give you money and request you to sign the transaction logbook.

Please see our Tariff Guide below.

How to Withdraw Cash from a t-kash Agent

- Visit the nearest T-kash Agent.

- Confirm the T-kash Agent has sufficient funds to process your transaction.

- Give the Agent your original identification document.

- Go to your T-kash Menu and select ‘Withdraw Cash’.

- Select ‘From Agent’enter the amounts.

- Confirm details, enter your T-kash PIN and press send.

- You will receive a T-kash SMS with a T-kash Code that is valid for 10 minutes.

- Give the Agent the T-kash Code to process your withdrawal request.

- The Agent will process your withdrawal request and you will receive a confirmation SMS from T-kash.

- The Agent will give you money and request you to sign the transaction logbook.

How to Send T-kash Money to Mobile

- Deposit money into your own account.

- Go to your T-kash Menu and select ‘Send Money’.

- Select ‘To Mobile’.

- Select ‘Enter Phone Number’or ‘Favorite’.

- Enter Phone Number or the name of the Favourite you wish to send money to.

- Enter Amount.

- A confirmation screen will pop up showing the details of the person, amount to be transferred & charges (e.g. Send Money to 0777 XXX XXX – CUSTOMER NAME, amount Kshs. XXX, Transaction Fee Kshs. XX)

- Enter T-kash PIN and press send.

- You will receive a confirmation SMS from T-kash.

How to Send Money from t-kash to a Bank Account

- Go to your T-kash Menu.

- Select ‘Send Money’.

- Select “To Bank”.

- Choose ‘Select Bank’ from the menu or from your saved ‘Favourite banks’.

- A list of banks will be displayed.

- Enter Account Number.

- Enter Amount.

- A confirmation screen will pop up showing the details of the Bank Account, amount to be transferred & charges (e.g. Bank Name: Bank of Africa, Account No: 123456789, Amount: Kshs. 100, Charges Kshs. 10)

- Enter your T-kash PIN and press send.

- You will receive a confirmation SMS from T-kash.

How to become a T-kash Agent

To become a tkash agent you must have;

- Certificate of incorporation for limited companies, certificate of registration for Sole Proprietor, and a Partnership deed for Partners.

- Bank statements for the last 6 months.

- Business should have been in operation for at least 6 months.

- Agent should have at least 3 shops that are ready to offer T-kash services.

- Minimum float of at least KShs.100, 000 for the *Agency Head Office.

- Minimum purchase of 100 lines.

The Benefits of using T-kash

- Agent number is not required when withdrawing cash from a t-kash agent

- No need of Till number when paying for goods

- You can transact (send) as little as ksh. 1 and maximum of ksh. 70,000

Download tkash: Term and Conditions